Pick Up This Split for Long-Term Retirement Income

The number of Americans aged 90 or older almost tripled from 1980 through 2010 and is projected to quadruple by 2050.1 Of course, reaching 90 is still an unusual accomplishment, but the average 65-year-old can expect to live another 19 years.2

The number of Americans aged 90 or older almost tripled from 1980 through 2010 and is projected to quadruple by 2050.1 Of course, reaching 90 is still an unusual accomplishment, but the average 65-year-old can expect to live another 19 years.2

A portfolio that provides steady income for both the short and the long term could help you enjoy a long, comfortable retirement. You might consider a split-annuity strategy to meet your needs.

A Contract for the Future

An annuity is a contract with an insurance company in which you agree to make one or more payments in exchange for a current or future income stream. An immediate annuity typically begins to pay an income to the contract holder immediately, whereas a deferred annuity begins paying an income at a specified time in the future.

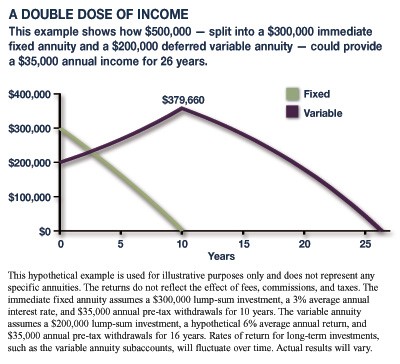

In the hypothetical illustration below, an individual purchases a $300,000 immediate fixed annuity, which offers a guaranteed annual interest rate of 3%, and a $200,000 deferred variable annuity, which carries more risk but pursues growth through investment options (subaccounts).

The immediate fixed annuity provides an annual income of $35,000 for 10 years. Meanwhile, the variable annuity accumulates tax deferred. Assuming the variable annuity subaccounts grow at a 6% average annual rate, the annuity value could reach $379,660 after 10 years, when the fixed annuity is exhausted. If the subaccounts keep growing at the same 6% rate, the investor could continue taking $35,000 annual withdrawals for another 16 years (see graph).

The immediate fixed annuity provides an annual income of $35,000 for 10 years. Meanwhile, the variable annuity accumulates tax deferred. Assuming the variable annuity subaccounts grow at a 6% average annual rate, the annuity value could reach $379,660 after 10 years, when the fixed annuity is exhausted. If the subaccounts keep growing at the same 6% rate, the investor could continue taking $35,000 annual withdrawals for another 16 years (see graph).

Withdrawals of annuity earnings are taxed as ordinary income and may be subject to a 10% federal income tax penalty if made prior to age 59 ½. Withdrawals reduce annuity contract benefits and values. Most annuities have surrender charges that are assessed during the early years of the contract if the annuity is surrendered.

Generally, annuities have contract limitations, fees, and charges, which can include mortality and expense charges, account fees, investment management fees, administrative fees, and charges for optional benefits. Any guarantees are contingent on the claims-paying ability of the issuing company. Annuities are not guaranteed by the FDIC or any other government agency; they are not deposits of, nor are they guaranteed or endorsed by, any bank or savings association.

The investment return and principal value of the variable annuity investment options are not guaranteed. Variable annuity subaccounts fluctuate with changes in market conditions. The principal may be worth more or less than the original amount invested when the annuity is surrendered.

Variable annuities are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the variable annuity contract and the underlying investment options, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1) U.S. Census Bureau, 2011

2) National Vital Statistics Reports, Volume 59, Number 4, 2011

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.