More Affordable Than You Might Think

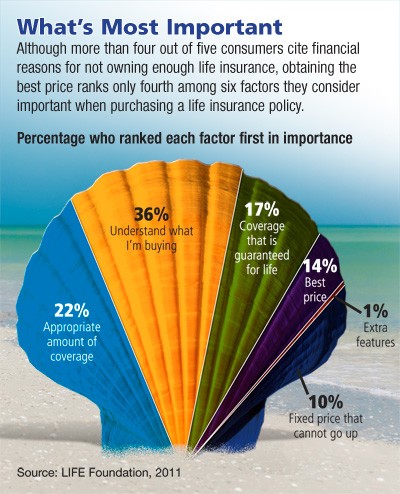

In a 2012 study, more than 80% of respondents cited financial reasons for not having enough life insurance coverage to meet their needs, yet they overestimated the cost of life insurance by almost three times the actual price.1 Considering these perceptions, it may not be surprising that life insurance ownership is at an all-time low, with many people believing they need more coverage2–3

This is one situation in which a little information might go a long way. Over the last decade, the cost of basic term life insurance has dropped by almost 50%, so this may be a good time to consider purchasing additional protection for your family.4

Preparing for a Certainty

There’s an old saying that the only certainties in life are death and taxes. Most people are forced to think about taxes every year, but it can be easy to ignore the inevitability of death, especially when you’re young and healthy. Yet this is typically the time when life insurance is most affordable. Even if you are older or facing medical challenges, you may be surprised by how cost-effective a policy could be.

Think for a moment about what could happen if you were no longer able to provide for your family. Would they face a significant change in lifestyle? Would they be able to pursue long-term goals such as a college education for your children or a comfortable retirement for your spouse? A life insurance policy with the appropriate level of coverage could help them live the way you would like them to live.

Types of Life insurance

Types of Life insurance

There are two basic types of life insurance: term and permanent. Term life insurance — which offers a death benefit if the insured dies within a specified time period — is usually the least expensive and may offer low-cost coverage during the years when you are most concerned about providing for your dependents’ needs. Permanent life insurance typically offers a lifetime benefit as long as you keep the policy in force by paying the premiums.

Although you may have term life insurance through work, group plans generally limit the coverage amount to a multiple of your salary. And, of course, your group coverage usually would end if you leave your employer. An individual policy could provide more consistent protection regardless of changes in your career.

The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. Before implementing a strategy involving life insurance, it would be prudent to make sure that you are insurable. As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. In addition, if a policy is surrendered prematurely, there may be surrender charges and income tax implications.

If financial concerns have held you back from obtaining the life insurance coverage you need, you may want to investigate the available options.

1, 3–4) LIFE Foundation, 2012

2) LIMRA, 2011

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.