Help Protect Your Assets

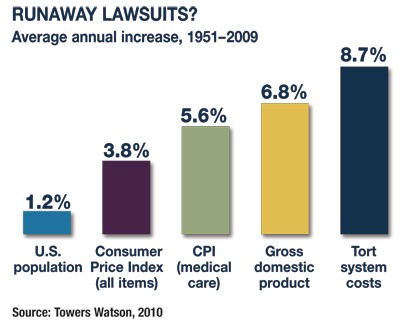

Lawsuits have become increasingly common in our society. From 1951 through 2009, the cost of torts (civil suits) rose at more than double the annual rate of general inflation and even surpassed the annual increase in medical expenses (see chart).

Lawsuits have become increasingly common in our society. From 1951 through 2009, the cost of torts (civil suits) rose at more than double the annual rate of general inflation and even surpassed the annual increase in medical expenses (see chart).

In this litigious environment, it is especially important to protect your assets and your future income. If you entertain often, have a dog or a swimming pool, or employ workers in your home, you may have additional exposure to a potential civil suit.

Standard homeowners and automobile insurance policies generally offer coverage in the event of a personal liability lawsuit. However, the policy limits may not be high enough to pay a substantial jury award. If you would like extra coverage at a relatively low cost, you might consider an umbrella insurance policy.

Typically, you can obtain $1 million in coverage for a few hundred dollars a year. However, you must usually purchase the maximum liability coverage on your homeowners and automobile policies; they serve as a deductible for the umbrella policy, which can provide additional coverage (up to the policy limits). Umbrella policies may also cover situations that are not included in standard policies, such as libel, slander, invasion of privacy, defamation of character, and other personal injuries.

Typically, you can obtain $1 million in coverage for a few hundred dollars a year. However, you must usually purchase the maximum liability coverage on your homeowners and automobile policies; they serve as a deductible for the umbrella policy, which can provide additional coverage (up to the policy limits). Umbrella policies may also cover situations that are not included in standard policies, such as libel, slander, invasion of privacy, defamation of character, and other personal injuries.

Although umbrella policies have long been a staple for wealthy households, many middle-income households have substantial home equity, retirement savings, and current and future income that could be used to satisfy a large judgment. Qualified retirement plan assets may have some protection from creditors under federal and/or state law (depending on the type of plan and jurisdiction), but even if your retirement savings may be protected, you would still be liable for any judgments.

You’ve worked hard to establish a solid financial base. In a world where it sometimes seems to be raining lawsuits, it might be wise to carry an umbrella.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.