An Introduction to Trusts

Many people think trusts are only for the rich, but that’s not necessarily the case. Most estates must go through the probate process, which can be costly and time-consuming. And with tax changes scheduled to take effect in 2013, even modest estates could be subject to federal estate taxes. Certain types of properly executed trusts may help avoid both of these potential liabilities.

Trusts can also be used for other purposes, such as to provide for a dependent with special needs, to maintain control of a legacy for your heirs, or to make a substantial contribution to your favorite charitable organization.

Understanding the Terms

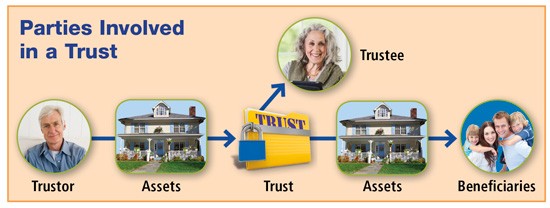

A trust is a legal arrangement under which one person or institution controls property given by another person for the benefit of a third party. The person giving the property is referred to as the trustor, the person controlling the property is the trustee, and the person for whom the trust operates is thebeneficiary. With some trusts, you could name yourself as the trustor, the trustee, and the beneficiary.

A trust can be revocable or irrevocable depending on the type of trust and the way it is constructed. The latter type cannot be easily modified or terminated.

A living trust is established and funded during your lifetime. When assets are transferred to a living trust, you technically no longer own them, so there is nothing to probate when you die. If you name yourself as the trustee, you can maintain full control of the assets, but doing so would generally negate the estate tax savings associated with the trust.

A testamentary trust takes effect upon your death, at which point it becomes irrevocable. It is usually established by a will, which means your estate would still go through probate. A testamentary trust is often used to help reduce estate taxes.

The use of trusts involves a complex web of tax rules and regulations. You should consider the counsel of an experienced estate planning professional before implementing such strategies.

The information in this article is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. Copyright © 2012 Emerald Connect, Inc.